It lacks a real economic transaction or asset transfer. Also, the price difference between the spot and future price can be viewed as interest (riba), which is strictly prohibited in Islamic finance principles that govern ethical trade and business dealings.

7 Reasons Future Trading is Considered “Haram”

Are you curious to know why future trading is known as haram (forbidden) according to Islamic Law?

Future trading, where people buy or sell assets at pre-decided future prices, is largely considered impermissible due to several important reasons based on Islamic finance principles.

Here are the main reasons that shed light on future trading is deemed haram:

1. Too Much Risk and Uncertainty:

Future contracts involve a lot of risk and uncertainty because the future prices are not known for sure. Islam teaches that there should be no ambiguity in financial dealings and excessive risk should be avoided.

2. Like Gambling:

The speculative nature of future trading, where profits/losses depend solely on market price changes rather than actual buying/selling of assets, is seen as similar to gambling. Gambling is strictly prohibited in Islam as it involves “qimar” (thriving on others’ losses).

3. No Real Asset Ownership:

In future trading, there is no real intention to take ownership or possession of the underlying assets like commodities or stocks. Islamic finance focuses attention on asset-backing for all transactions for them to be considered valid.

4. Interest-Like Elements:

The difference between the spot price and future price in a futures contract can be viewed as interest or riba. Riba (interest/usury) is completely prohibited as it is an unfair form of earning money without any productive effort.

5. Exploitation and Unfair Practices:

Future markets are prone to insider trading, price manipulation, and other unethical practices that take advantage of people. Islam promotes justice, fair dealings, and transparency in all business activities.

6. Promotes Greed and Materialism:

The highly speculative nature of futures trading fuels greed, excessive materialism, and the desire to make easy profits without hard work – traits that Islam discourages as they lead to spiritual degradation.

7. Diverts from Real Economic Progress:

Excessive future trading directs resources away from real economic activities like production, manufacturing, and ethical investment – which Islam prioritizes for sustainable growth and development.

Based on these reasons, it is evident why future trading is widely regarded as impermissible (haram) according to the principles of Islamic finance. Engaging in ethical, productive and risk-controlled financial practices in line with Shariah is crucial for Muslims.

Quran Teachings on Prohibitions Linked to Future Trading

Future trading is widely regarded as haram in Islam due to its involvement with concepts like riba (interest), qimar (gambling), gharar (excessive risk) and maysir (speculation). The Quran and Hadith provide clear guidance on these prohibited elements, which form the basis for considering future trading as haram.

Let’s explore each of these concepts in detail below:

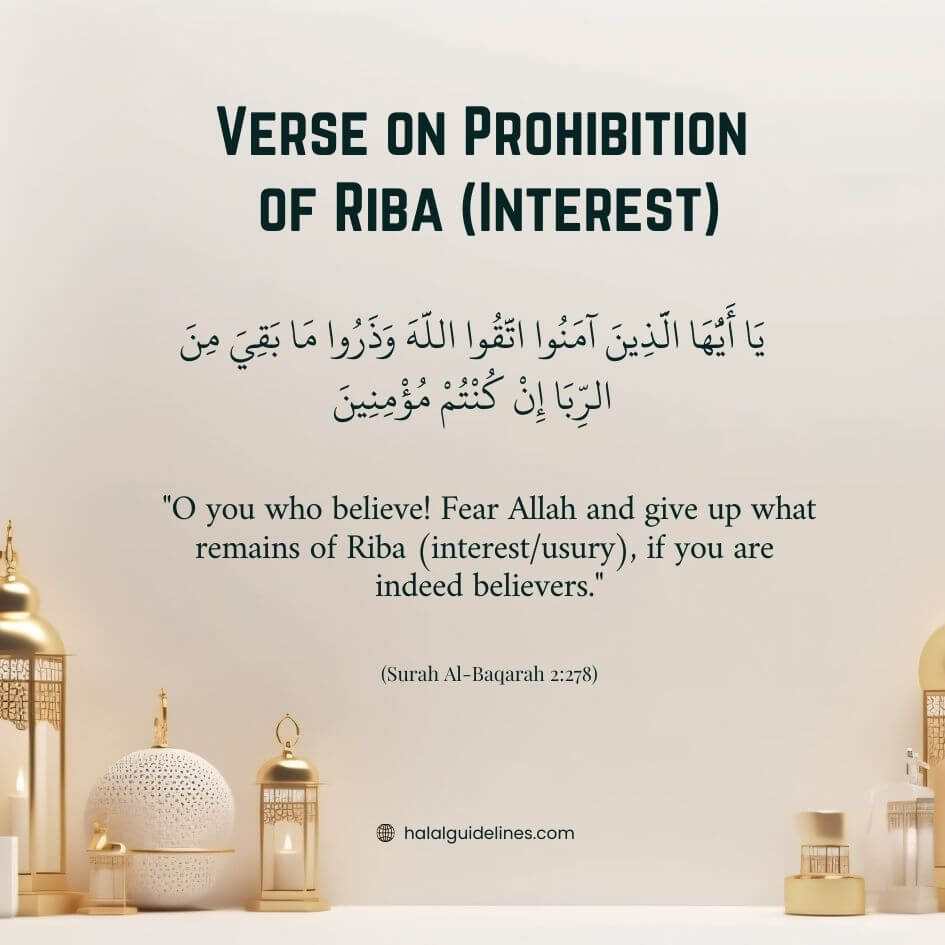

The Stern Prohibition of Riba (Interest) in the Quran

Verse in text Format:

يَا أَيُّهَا الَّذِينَ آمَنُوا اتَّقُوا اللَّهَ وَذَرُوا مَا بَقِيَ مِنَ الرِّبَا إِنْ كُنْتُمْ مُؤْمِنِينَ (البقرة: 278) Translation: “O you who believe! Fear Allah and give up what remains of Riba (interest/usury), if you are indeed believers.” (Surah Al-Baqarah 2:278)

This verse prohibits Muslims from engaging in riba, which refers to interest-based transactions. In future trading, the price difference between spot and future prices can be viewed as interest, making it impermissible according to Islamic teachings.

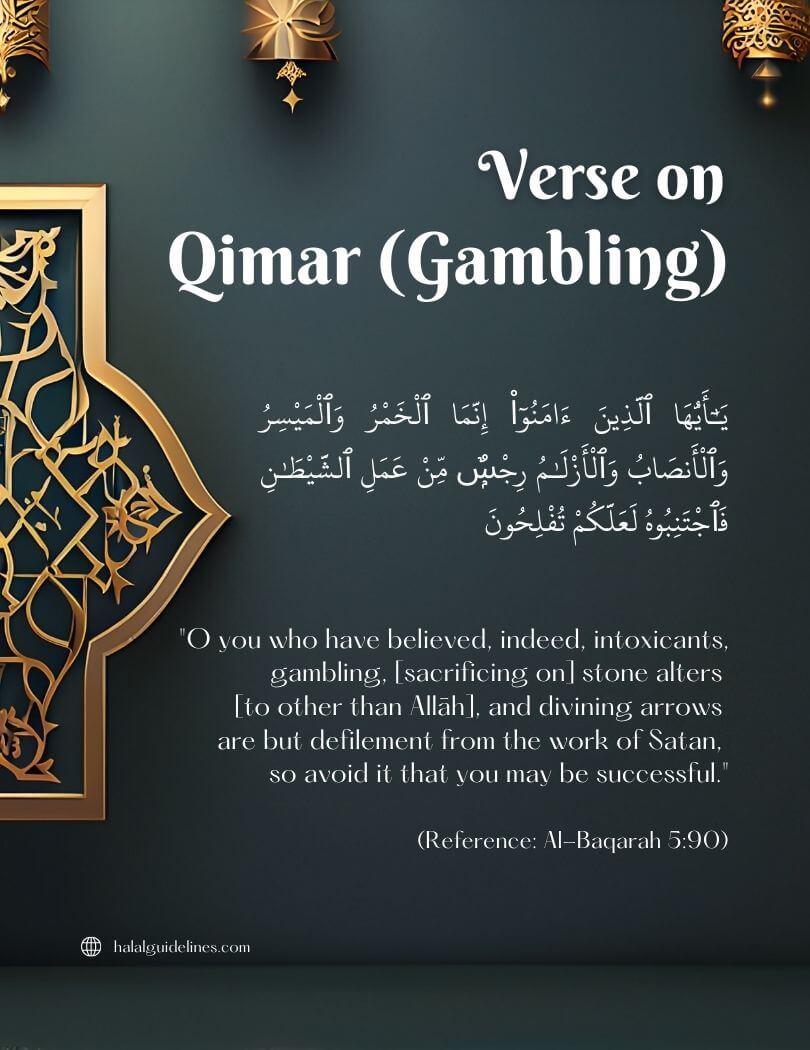

Forbidding of Qimar (Gambling) in All Forms

Here is the verse in the text below:

يَـٰٓأَيُّهَا ٱلَّذِينَ ءَامَنُوٓا۟ إِنَّمَا ٱلْخَمْرُ وَٱلْمَيْسِرُ وَٱلْأَنصَابُ وَٱلْأَزْلَـٰمُ رِجْسٌۭ مِّنْ عَمَلِ ٱلشَّيْطَـٰنِ فَٱجْتَنِبُوهُ لَعَلَّكُمْ تُفْلِحُونَ English Translation: “O you who have believed, indeed, intoxicants, gambling, [sacrificing on] stone alters [to other than Allāh], and divining arrows are but defilement from the work of Satan, so avoid it that you may be successful.” (Reference: Al-Baqarah 5:90)

This verse bans all types of gambling (qimar). Future trading is often seen as similar to gambling because it’s based on speculation. In future trading, profits and losses depend only on market changes instead of real economic activities.

These verses from the Quran show that future trading is not allowed (haram) in Islam because it involves things that are forbidden. Muslims should focus on ethical, productive, and safe financial activities that follow Islamic rules.

Islamic Scholar Stance on Future Trading

Dr. Zakir Naik, a well-known scholar, has shared his thoughts on this topic, giving a detailed explanation from an Islamic viewpoint.

Here is his point of view on future trading:

He said that futures trading is not allowed in Islam because it involves too much guessing and risk, similar to gambling, which is forbidden. In futures trading, you don’t own the asset fully; you just pay part of the price now and the rest later, hoping the market will go your way.

This kind of trading relies on others to cover your risks, adding to the uncertainty. Islam requires financial deals to be clear and certain, which futures trading is not.

Here is the full video of him below you can watch it for your confirmation:

Dr. Zakir Naik, a respected scholar, shares his thoughts on future trading, guided by the Quran and Sunnah. He backs up his view with verses from the Quran and sayings of Prophet Muhammad (peace be upon him).

His message is clear: Muslims should avoid future trading and opt for ethical and permissible ways of handling their finances.

Choose Halal Over Haram (Advice For You)

In the end, we as Muslims should follow Islamic finance principles. Future trading is widely considered haram (prohibited) due to its links with riba (interest), qimar (gambling), gharar (excessive risk), and maysir (speculation).

Islam encourages ethical and productive financial activities that benefit society. Instead of speculative practices like future trading, explore halal (permissible) investment options that promote real economic growth.

May Allah guide us and always protect us from haram income, and may we always earn halal for our children and families. Ameen!

More Questions Asked by Muslims Related to Future Trading

What is future trading?

Future trading is when people make agreements to buy or sell something at a future date but usually don’t plan to own the item. They do this to make money from price changes rather than trading real goods.

Why is Binance future trading not halal (permissible)?

Binance future cryptocurrency trading is not permissible (haram) in Islam as it lacks real asset ownership, resembles interest, and is speculative like gambling.

Are there any Islamic alternative investments instead of future trading?

Shariah-compliant investment options include investing in Halal businesses, real estate, Murabaha (cost-plus financing), and Sukuk (Islamic bonds). These methods follow Islamic principles by avoiding interest and excessive speculation, focusing on real assets and ethical practices.